Products

Site Search

Help shoppers find what they’re looking for faster with hyper-relevant on-site search results.

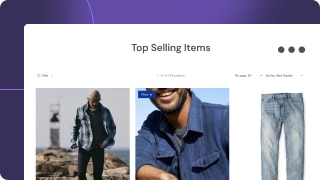

Merchandising

Ecommerce site merchandising that puts the right products in front of shoppers—while putting you in control.

Personalization

Influence every interaction with individualized recommendations based on past behavior and activity.

Reporting & Insight

Unlock the power of your own data with analytics designed to help you optimize your site experience.

Predictive Product Bundling

Instantly boost your average order value with intelligent suggestions based on each customers’ interests.

Featured Product

Predictive Product Bundling

Make it easier for shoppers to find—and purchase—everything they’re looking for with Predictive Product Bundling.

Learn more

Resources

Industry

All Industries

Topic

All Topics

Featured Resource

Elevating your website conversion rate in 2024

Whether you’re looking to update your conversion rate optimization strategy, or building one from scratch, we’ve put together all the actionable tips you need in one comprehensive ebook.

Read more